TAX PLANNING

Tax planning is not as hard as it seems. Every taxpayer should look to optimise their tax outgoing. Tax-saving investments should be considered as they not only save taxes but also help in accumulating a corpus which can be used to cover various life events. If you do not keep a regular watch on your expected tax liability then at the end of the year you will find it difficult to invest a huge amount all of a sudden to save tax.

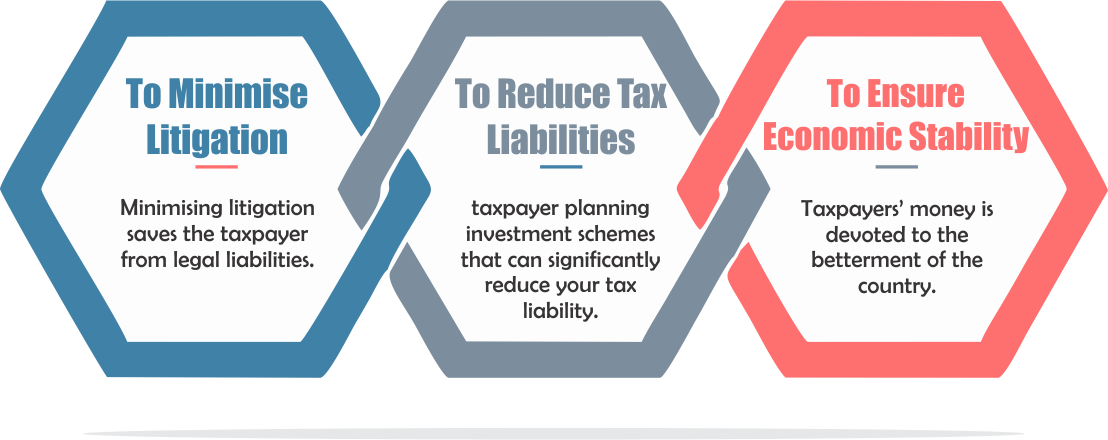

Tax Planning is an activity conducted by the Person to reduce the tax liability. Tax planning is a legitimate way of reducing your tax liabilities in a financial year. It helps you utilise the tax exemptions, deductions, and benefits offered by the authorities in the best possible way to minimise your liability.

Indian law offers a variety of tax saving options for taxpayers, allowing for a large range of options for exemptions and deductions through which you could limit your overall tax output.

The deductions are available from Sections 80C through to 80U and can be utilised by eligible taxpayers. There are many other sections under the Income Tax Act, 1961 such as exemptions and tax credits that can lower your tax liabilities.